In today's rapidly evolving economy, mastering financial planning has become more crucial than ever for business owners. The ability to effectively manage finances not only ensures the sustainability of a business but also paves the way for future growth and prosperity. Many entrepreneurs find themselves juggling various responsibilities, from day-to-day operations to long-term strategy, making it challenging to navigate the complexities of financial management. This guide is designed to offer insights and tools tailored specifically for business owners, empowering you to take charge of your financial future.

As you explore the landscape of financial planning, you will discover essential strategies that cover everything from budgeting and investing to estate planning and retirement. Technology plays a pivotal role in this journey, with innovative financial planning software and AI-enhanced wealth management services transforming the way high-net-worth individuals and business owners approach their finances. Whether you are just starting your entrepreneurial journey or looking to refine your established plans, this comprehensive guide will equip you with the knowledge and resources needed to build a robust financial framework that stands the test of time.

Understanding Financial Planning

Financial planning is the process of setting goals, developing a strategy, and managing finances to achieve one's objectives. It provides a roadmap for business owners to navigate today's economy, ensuring that they can effectively manage their resources and make informed decisions. A comprehensive financial plan incorporates various elements such as budgeting, investing, and retirement planning to ensure long-term success.

Effective financial planning allows business owners to identify potential risks and opportunities, helping them allocate their resources wisely. With the right financial planning tools, they can analyze their current situation and project future needs. This proactive approach not only aids in achieving short-term goals but also helps in building a sustainable business that can adapt to changing market conditions.

Moreover, financial planning is crucial for estate planning and wealth management. Business owners must consider how their legacy will be managed and transferred. Collaborating with a wealth management advisor can help create a comprehensive estate plan that accounts for taxation, investments, and future generations. By understanding the intricacies of financial planning, business owners can ensure their financial well-being now and into the future.

Key Strategies for Business Owners

Effective financial planning is essential for business owners who want to secure their financial future. One key strategy is to develop a comprehensive financial plan that encompasses both personal and business finances. This plan should include clear goals, a budget, and a thorough analysis of cash flow. By understanding their financial situation holistically, business owners can make informed decisions that align with their long-term objectives, whether that means reinvesting in the business or preparing for retirement.

Another important strategy is establishing a robust estate plan. Business owners need to consider how their business assets will be handled in the event of their passing or retirement. Creating a comprehensive estate plan ensures that a business can continue operating smoothly and that the owner's wishes regarding asset distribution are respected. This may involve setting up trusts, wills, and designating beneficiaries appropriately, all of which are crucial for high-net-worth individuals looking to protect their wealth and legacy.

Lastly, leveraging technology in financial planning can greatly enhance a business owner's ability to manage finances efficiently. Utilizing financial planning software and dashboards allows for real-time tracking of expenses, investments, and overall financial health. Additionally, incorporating AI in wealth management can provide personalized investment strategies and insights that were previously inaccessible. By embracing these tools, business owners can streamline their financial planning process, enabling them to focus on growth and sustainability in today's economy.

Wealth Management Essentials

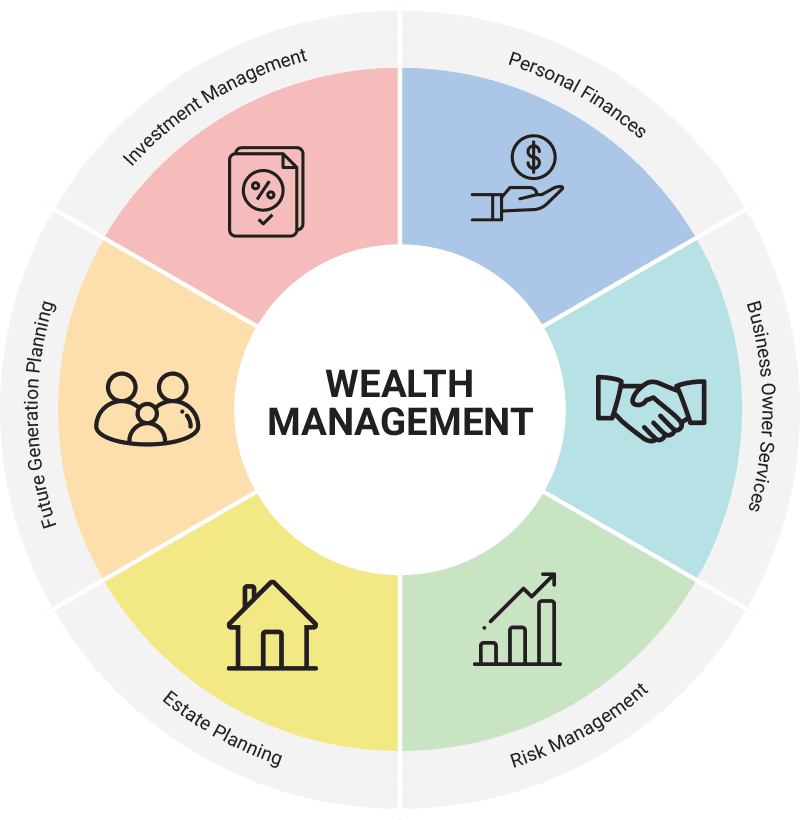

Wealth management is an integral part of financial planning for business owners, ensuring that individuals can navigate the complexities of their finances effectively. A wealth management strategy synthesizes various financial services, including investment management, estate planning, and tax strategies, tailored to meet the unique needs of high-net-worth individuals. This comprehensive approach helps business owners make informed decisions that not only protect their wealth but also promote growth and sustainability over time.

Understanding the importance of a comprehensive estate plan cannot be overstated. It serves as a roadmap for asset distribution, ensuring that business owners' wishes are fulfilled upon their passing. A well-crafted estate plan addresses key issues such as minimizing estate taxes, safeguarding assets from creditors, and providing clarity for successors. Regularly reviewing and updating the estate plan is essential, particularly as personal and business circumstances evolve.

In today's economy, leveraging technology and innovative financial planning tools enhances wealth management strategies significantly. Advanced financial planning software, coupled with AI, enables business owners to gain deeper insights into their portfolios and optimize investment decisions. This technological edge allows for more efficient monitoring of financial goals and progression toward retirement, ultimately positioning business owners to achieve long-term financial success.

Technology's Role in Financial Planning

In today's economy, technology has revolutionized the way business owners approach financial planning. From sophisticated software that streamlines budgeting to applications that offer real-time investment tracking, entrepreneurs have access to a variety of tools designed to simplify the financial management process. These innovations allow for more precise forecasting, enabling business owners to make informed decisions that enhance their financial strategies. With the ability to analyze data quickly, technology empowers owners to adapt to market changes efficiently.

One key aspect of technology in financial planning is the rise of wealth management software. This software not only helps in managing investments but also plays a crucial role in comprehensive estate planning. Business owners can utilize these tools to create detailed financial plans that integrate various components, including tax strategies and retirement savings. Moreover, advancements in artificial intelligence allow for personalized financial insights, enabling a tailored approach to wealth management that meets individual objectives and risk tolerance.

As technology continues to progress, its impact on financial planning will only grow stronger. The development of financial planning dashboards means that business owners can visualize their financial health at a glance, tracking key performance indicators without getting bogged down by complex spreadsheets. Additionally, the infusion of AI and machine learning in these tools helps in identifying patterns and potential pitfalls, helping owners avoid common financial planning mistakes. With the right technology, today's entrepreneurs can secure their financial futures, paving the way for sustained growth and prosperity.

Common Financial Planning Mistakes

Many business owners make the error of neglecting to create a comprehensive financial plan. Without a clear roadmap, it becomes challenging to navigate the various financial obligations and opportunities that arise in today's economy. This oversight can lead to missed investment opportunities, ineffective budgeting, and inadequate preparation for future expenses such as retirement or estate planning. Establishing a solid financial foundation is essential for long-term success and stability.

Another frequent mistake is failing to regularly review and adjust financial plans. The economic landscape is always changing, and what worked a few years ago may no longer be relevant. Business owners often overlook the importance of adapting their strategies in response to market trends, evolving regulations, or personal financial situations. Regular assessments ensure that financial strategies remain aligned with both short-term goals and long-term visions.

Additionally, many business owners underestimate the value of seeking professional advice. Whether it be from a wealth management advisor or a financial planning firm, outside expertise can provide insights that individuals may not consider on their own. The risk of going it alone can lead to costly errors, such as inadequate estate planning or poor investment choices. Engaging with a financial professional can enhance decision-making and foster a more robust financial future.

Tools and Resources for Effective Planning

To navigate the complexities of financial planning, business owners can leverage a variety of tools and resources designed to streamline the process. Financial planning software has become increasingly popular, providing comprehensive solutions that assist in budgeting, forecasting, and investment management. These platforms often come equipped with user-friendly interfaces that allow business owners to input data effortlessly, track financial performance, and generate insightful reports. Utilizing these tools can significantly enhance decision-making capabilities and ensure that finances are managed efficiently.

In addition to software, various financial planning resources are available, including online courses and certifications that can deepen knowledge and skills. Many organizations offer training specifically tailored to business owners, focusing on aspects such as estate planning and wealth management strategies. Engaging in these educational opportunities can empower business owners to make informed decisions regarding their financial futures, helping them avoid common pitfalls and capitalize on potential growth opportunities.

Utilizing the latest technology in financial planning can also provide a competitive edge. Artificial intelligence and analytics tools can help identify trends and provide personalized insights, making it easier for business owners to adapt their strategies in today’s dynamic economy. By staying informed about financial planning tools and integrating them into their overall management strategies, entrepreneurs can foster a more robust financial foundation, ultimately leading to long-term success and stability.

Planning for the Future

Effective financial planning is crucial for business owners who want to secure their financial future and achieve long-term success. Establishing a comprehensive financial plan allows entrepreneurs to align their business goals with personal financial objectives. By assessing current financial situations and projecting future income, business owners can create a roadmap for achieving their desired lifestyle in retirement, managing debt, and investing wisely. This strategy not only enhances decision-making but also provides a sense of financial security that can motivate and inspire continued growth.

In today's economy, leveraging technology in financial planning has become essential. Business owners can utilize financial planning software and dashboards to gain real-time insights into their finances, helping them make informed choices quickly. Tools powered by artificial intelligence can offer predictive analytics and personalized recommendations, optimizing wealth management strategies for high-net-worth individuals. Staying updated on financial planning tools enables entrepreneurs to streamline their processes and focus on what they do best—running their businesses.

Ultimately, planning for the future involves regular reviews and adjustments to financial strategies. As circumstances change, whether due to market conditions, personal milestones, or shifts in the business landscape, it is imperative for business owners to revisit their comprehensive financial plans. Engaging with a wealth management advisor can provide valuable expertise and guidance on effective estate planning and investment strategies, ensuring that individuals are prepared for both foreseeable challenges and unexpected opportunities as they navigate their financial journeys.